Last week I joined Kristin Tyler from LAWCLERK to talk about how lawyers can use subscriptions to build a healthy law firm.

Financially Legal is a podcast for law firm CFOs dealing with financial aspects of the business of law. Host, Emery Wager, talks with law firm leaders, academics, business professionals and thought leaders to provide compelling and provocative insights at the intersection of finance, economics, and law.

Webinar Recording: Building a Scalable Practice with Subscriptions

Topics: Subscriptions, Business of Law

Why law firms should consider integrated ACH

In a weird way, eCheck or ACH payments are an anachronism. Or the name "eCheck" is, at least.

Topics: Business of Law, Payments

Episode 20: How do you build a “cloud-based” law firm? An interview with Tim Parlatore and Elana Bertram of Parlatore Law Group

If you’ve considered or are considering a virtual, remote, distributed or cloud-based law firm model, this episode is for you.

How to Protect Your Law Firm from Chargebacks

A chargeback is a credit card processing term for a transaction that is processed successfully but is later reversed. This article is focused on how to limit chargebacks before they occur. If your law firm has already received a chargeback notification, see How to Dispute a Chargeback for Law Firms.

Topics: Business of Law

Webinar: Building a Scalable, Healthy Practice with Subscriptions

We've been talking a LOT about subscription legal services lately. In fact, check out our recently launched Subscription Legal Services Resource Center where we've collected a bunch of our best subscription-related content all in one place.

Topics: Subscriptions, Business of Law

Why and How You Should Get Paid Electronically (from ABA GPSolo Magazine)

Note: This article was originally printed in the November/December 2020 issue of the ABA GP Solo Magazine.

Topics: Business of Law

Episode 19: Should you have a law firm CFO? An interview with Kenna Valentine from the e2e

“I was told there’d be no math.” It’s a common joking refrain for law students and even practicing lawyers. “I went to law school to help people,” so many lawyers tell me. But a firm needs to pay for you - and itself - in order to keep helping people. Let’s face it: law firms are businesses. And the better a firm runs, the more people it can help. So understanding the finance and economics of a legal services business is crucial. That’s where Kenna comes in.

Confido Legal's Dan Lear on Law Firm Autopilot with Ernie 'the Attorney' Svenson

Ernie “the Attorney” Svenson has been thinking about law, tech, and making law practices work better for lawyers for a long time. So, we were stoked when he invited our own Dan Lear to be a guest on his Law Firm Autopilot podcast.

The occasion was the recent release of Confido Legal’s subscription legal services white paper and the topic was . . . wait for it . . . subscription legal services.

Dan and Ernie talked about subscription fatigue (fact or fiction?), the importance of a solid value proposition for subscription legal services, how to get started with subscription legal services, how subscriptions can allow you to leverage your highest and best use as an attorney, the economics of law firm subscriptions and how that’s related to niche marketing, and how Confido Legal is different from LawPay.

Check out the episode here and a big thanks to Ernie for the invitation!

Topics: Business of Law, Confido Legal News

Virtual Learning: Credit Card Fees for Law Firms

For many law firms, credit card processing fees are a sizeable item on the income statement. Because there are a variety of different types of processing fees, it can be difficult to determine exactly how much a firm is paying and how those fees can be reduced.

This event is designed for accounting and financial consulting professionals who work with and advise law firms. We will cover:

Topics: Firm Financials, Credit Card Fees, Business of Law

The Confido Legal Subscription Legal Services White Paper

We're very pleased to announce the release of our subscription legal services white paper. Six months and over 40 pages in the making, this is every law firm's guide to getting started with subscription legal services.

Topics: Subscriptions, Business of Law

Can lawyers accept Apple Pay?

Getting paid electronically is more relevant than ever in our current pandemic moment. It's no wonder, then, that lawyers have lots of questions about how to get paid without cash or paper checks.

Topics: GPay, Apple Pay, Venmo, Business of Law

Tools for your subscription legal services offering (Part 5)

Note: This is the fifth in a series of posts on the what, why, and how of subscription legal services. You can find our first post “What are subscription legal services?” here. Our second post, "The 'why' of subscription legal services (Part 2)" is here. The third post, "The ethics of subscription legal services (Part 3)" is here. Part 4, "How to launch your subscription legal services offering (Part 4)," can be found here.

We at Confido Legal recently launched a suite of tools that make offering subscription legal services easy. If you'd like to learn more about the tools we’ve built, contact us.

We also have three episodes of our Financially Legal podcast featuring lawyers who have built and are offering subscription legal services. Check out those episodes with Jon Tobin, Beth Lebowitz, and Kimberly Bennett. You can also hear me and Megan Zavieh discuss the ethics of subscription legal services on her Financially Legal podcast episode.

Topics: Subscriptions, Business of Law

Episode 18: How do you get started with a subscription legal services offering? An interview with Allen Rodriguez of One400

Allen Rodriguez is a legal product development strategist who has been serving the legal industry for over 18 years. He’s currently the Founder and CEO of the law innovation agency One400. Before that he was the Director of Attorney Services at LegalZoom, where he helped LegalZoom figure out their, now very successful, subscription and lawyer-assisted offerings. He got his start in the legal sector running operations at the Los Angeles County Bar Association’s Lawyer Referral Service.

Topics: Financially Legal Episodes, Subscriptions

How to launch your subscription legal services offering (Part 4)

Note: This is the fourth in a series of posts on the what, why, and how of subscription legal services. You can find our first post “What are subscription legal services?” here. Our second post, "The 'why' of subscription legal services (Part 2)" is here. The third post, The ethics of subscription legal services (Part 3) is here. We at Confido Legal recently launched a suite of tools that make offering subscription legal services easy. If you'd like to learn more about the tools we’ve built, contact us.

We also have three episodes of our Financially Legal podcast featuring lawyers who have built and are offering subscription legal services. Check out those episodes with Jon Tobin, Beth Lebowitz, and Kimberly Bennett. You can also hear me and Megan Zavieh discuss the ethics of subscription legal services on her Financially Legal podcast episode.

Topics: Subscriptions, Business of Law

Litigation from the Client's Perspective - An Interview with Dan Price

Recently, our team invited seasoned litigator Diana Siri Breaux, a partner at Summit Law Group in Seattle, to interview Confido’s founder and CEO Dan Price about this very topic. As a longtime business owner, Dan has his fair share of experience with the legal system. In 2016, that experience reached new levels when Dan’s brother and co-founder, Lucas Price, took him to court after alleging that Dan’s decisions as CEO--including the decision to raise Confido’s minimum wage to $70,000 a year--had cost him money as a minority shareholder. At stake was not just millions of dollars but the very existence of the company--and the jobs of its 120+ employees.

Topics: Firm Financials, Business and Culture, Business of Law

Legal-ize QuickBooks with Confido Legal and LeanLaw

Many law firms use QuickBooks as their accounting solution. Some firms even use QuickBooks to send invoices. But QuickBooks as a complete time-keeping and billing solution?

Topics: QuickBooks, Business of Law, Confido Legal News

Episode 17: How do clients decide to hire a law firm? And how can decision science help you in your practice? An interview with Nika Kabiri of Kabiri Consulting.

Nika Kabiri is a JD, a PhD, a decision science consultant, teacher, and writer. If that’s not enough for you, just know she’s a rock star. Previously Nika was the Director of Strategic Insights at the online legal marketplace Avvo. Whether through market research, tireless and effective advocacy, or her amazing public speaking skills in that role Nika helped Avvo and the legal industry better understand the legal consumer.

Topics: Financially Legal Episodes

The ethics of subscription legal services (Part 3)

Note: This is the third in a series of posts on the what, why, and how of subscription legal services. You can find our first post “What are subscription legal services?” here. Our second post, "The 'why' of subscription legal services (Part 2)" is here. We at Confido Legal recently launched a suite of tools that make offering subscription legal services easy. If you'd like to learn more about the tools we’ve built, contact us.

We also have three episodes of our Financially Legal podcast featuring lawyers who have built and are offering subscription legal services. Check out those episodes with Jon Tobin, Beth Lebowitz, and Kimberly Bennett. You can also hear me and Megan Zavieh discuss the ethics of subscription legal services on her Financially Legal podcast episode.

Topics: Subscriptions, Business of Law

Litigation from the Client's Perspective - Event with Dan Price

Have you ever been caught in the middle of a case with no idea what your client is thinking? Take this opportunity to get inside the mind of a CEO who's been there.

In this virtual event, Diana Siri Breaux, partner at Summit Law Group in Seattle, interviews CEO Dan Price of Gravity Payments to uncover the answers to these and many other questions:

Topics: Business and Culture, Confido Legal News

The “why” of subscription legal services (Part 2)

Note: This is the second in a series of posts on the what, why, and how of subscription legal services. You can find our first post “What are subscription legal services?” here. We at Confido Legal recently launched a suite of tools that make offering subscription legal services easy. If you'd like to learn more about the tools we’ve built, contact us.

We also have three episodes of our Financially Legal podcast featuring lawyers who have built and are offering subscription legal services. Check out those episodes with Jon Tobin, Beth Lebowitz, and Kimberly Bennett. You can also hear me and Megan Zavieh discuss the ethics of subscription legal services on her Financially Legal podcast episode.

“Subscription-based legal services? Stop right there.”

Topics: Subscriptions, Business of Law

Episode 16: Could you be an outsourced general counsel? An interview with Beth Lebowitz from Auxana and Nimbus Legal

Subscription-based outsourced fractional general counsel sounds like a mouthful, but it’s not really that complicated. A fixed monthly fee for part of a lawyer’s time offering business advice to a company. The examples of a variety of different types of subscription offerings in our recent five-part series on subscription legal services is all the evidence you need. Beth Lebowitz believes that this outsourced general counsel model is as good for lawyers as it is for clients. In fact, she’s so committed to it that she’s founded both a law firm, Nimbus Legal, and a marketplace/community, Auxana, around the model.

Topics: Financially Legal Episodes, Payment Methods ,Subscriptions

Confido Legal Presents at the ABA Dispute Resolution Tech Expo

This September I had the pleasure of speaking to the innovative lawyers, mediators and greater dispute resolution community members at the American Bar Association's Dispute Resolution Tech Expo.

Topics: Firm Financials, Key Performance Metrics, IOLTA, Business of Law, Confido Legal News

What are subscription legal services? (Part 1)

Note: This is the first in a series of posts on the what, why, and how of subscription legal services. We at Confido Legal recently launched a suite of tools that make offering subscription legal services easy. If you'd like to learn more, contact us here.

We also have two episodes of our Financially Legal podcast on subscription legal services featuring lawyers who have built and are offering subscription legal services. Check out those episodes with Jon Tobin and Kimberly Bennett.

If you bill time on an hourly basis for long enough you begin to ask yourself some troubling questions: Should I DIY remodel my bathroom? Or are those 70 hours better spent billing clients at an exponentially higher rate of return, while I pay a plumber to screw the job up better than I ever could? Should I do my own laundry? Or should I bill another client? Should I walk the dog? Or should I set the dog adrift on an iceberg into the ocean, saving myself countless hours that could be used to bill clients in the future?

Topics: Subscriptions, Business of Law

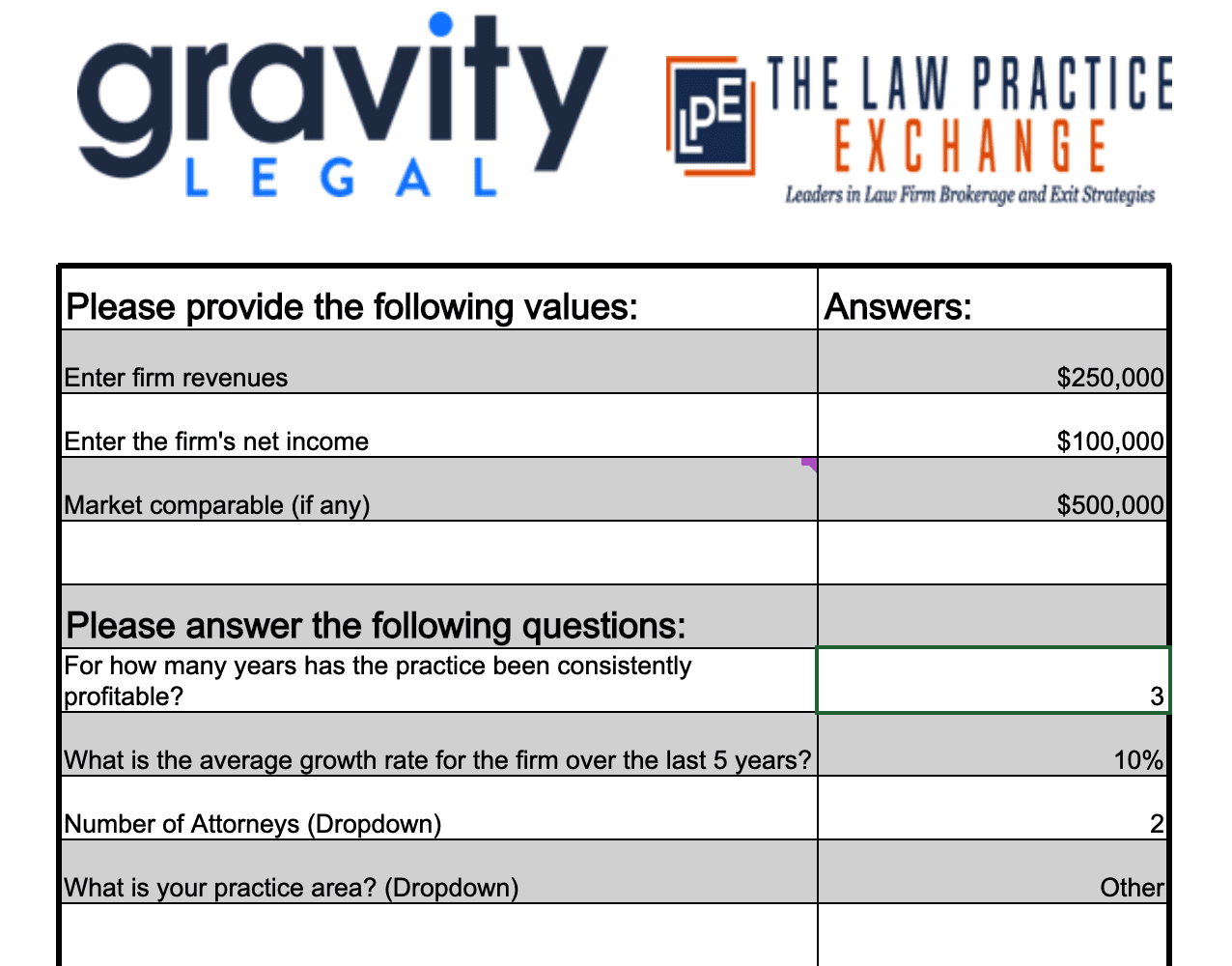

Webinar: What's your law practice worth?

A couple of weeks back we worked with Tom Lenfestey from the Law Practice Exchange to develop a simple calculator to help legal professionals to estimate the value of their legal practice. We launched the calculator in conjunction with an episode of our Financially Legal podcast in which I interviewed Tom and discussed the whys and hows of law practice valuation as well as buying and selling practices.

Topics: Business and Culture, Business of Law

Episode 15: Can you do that with your law practice? An interview with Megan Zavieh of Zavieh Law and Lawyers Gone Ethical

Lawyers can usually think of lots of possible reasons why trying something new in their practice is “against the rules.” Megan Zavieh is a California state bar defense attorney (who lives in Georgia!) and she’s not messing around. Instead, she’s launching a subscription legal services offering, cheering regulatory changes related to non-lawyer ownership and breaking down the rules around shifting credit card processing fees to clients or selling your law practice. Megan’s got some great takes on all of this plus how to run an ethical, forward-looking firm in the time of COVID and beyond.

Topics: Financially Legal Episodes

Episode 14: How do you sell a law practice? An interview with Tom Lenfestey from the Law Practice Exchange

It’s common for dentists or doctors to sell their practices but far less common for lawyers to do so. And a Zillow-like marketplace for law practices? Forget about it. And yet, that’s just what Tom Lenfestey is doing. Tom has built his business, The Law Practice Exchange, to increase liquidity in a market for law practices and evangelize the buying and selling of law practices as a legitimate option for the development, growth, and conclusion of a lawyer’s professional efforts. Tom has some valuable tips to prepare your practice for sale, how to get the most out of a sale, how to find a buyer, and much more.

Topics: Financially Legal Episodes

What's your law practice worth?

TLDR: Just skip the nonsense and give me a link to the law practice valuation calculator.

A few years ago I was trying to figure out what to do with my legal career. I met with a friend and mentor for whose firm I'd worked during law school. Perhaps sensing my trepidation about the future this close-to-retirement lawyer said "I'll give you my practice."

Topics: Business and Culture, Business of Law

Episode 13.5: How do clients wish you talked about money? A mini-podcast with Confido Legal’s own Emery Wager

Our recent podcast on how lawyers talk to clients about money inspired Confido Legal’s own Emery Wager to think about how lawyers had talked to him about money. A client of many lawyers at Gravity Payments (our parent company), Emery came up with a list of five things he wishes lawyers would do when they talk to clients about money. We dig in on this mini-episode of Financially Legal.

How should lawyers think about money? The experts weigh in

Listeners and readers have been pretty interested in our recent podcast on how lawyers talk to clients about money and our recent blog post about how one client (and Confido Legal team member) wishes lawyers talked to them about money. So, we decided to ask the experts how lawyers should talk to clients about money.

Topics: Firm Financials, Business of Law

Lawyers Putting Clients On Payment Plans

This is a guest post by divorce attorney and firm owner, Russell Knight, of Chicago, Illinois.

Almost all lawyers have a retainer or a large initial payment for legal services. Lawyers and clients enter into engagement agreements which specify how that retainer or payment is to be accounted for. Specifically, the money will be applied towards the lawyer’s hourly billing or specifically itemized tasks.

Topics: Firm Financials, Business of Law

Search Financially Legal

Posts by Tag

- Business of Law (171)

- Firm Financials (78)

- Financially Legal Episodes (69)

- Accounting (55)

- Surcharging (52)

- Business and Culture (37)

- Confido Legal News (32)

- Product Updates (17)

- Credit Card Fees (15)

- Legal Case Management (11)

- Subscriptions (10)

- Key Performance Metrics (9)

- IOLTA (6)

- Integrations (6)

- Lawyer Communities (5)

- Zapier (3)

- Payments (2)

- QuickBooks (2)

- QuickBooks Integration (2)

- Stored Payment Methods (2)

- Apple Pay (1)

- Civil Rights (1)

- Clients (1)

- Fidu (1)

- Flat Fee Billing (1)

- GPay (1)

- Invoices (1)

- Payment Methods ,Subscriptions (1)

- Payment automation (1)

- Venmo (1)

Get the Latest from Financially Legal

-2.png)

.png)