Greg Garman is a busy man. One of the founders of a 20 person law firm in Las Vegas, Greg is also the co-founder and CEO of LAWCLERK, an online marketplace for freelance legal help. In this episode, Greg shared some great insights on how and why he thinks right around 20 lawyers is the sweet spot for a small law firm.

Financially Legal is a podcast for law firm CFOs dealing with financial aspects of the business of law. Host, Emery Wager, talks with law firm leaders, academics, business professionals and thought leaders to provide compelling and provocative insights at the intersection of finance, economics, and law.

Episode 13: Is there an ideal size for a law firm? And what, if anything, does that have to do with the online legal gig economy? An interview with Greg Garman from LAWCLERK

From the Client's Perspective: How I Wish My Lawyer Would Talk about Money

I’ve put it off all week, but the time has come. I need to pay our law firm. They do great work and have helped protect our company during difficult times. But paying their bill is not a pleasurable experience.

Topics: Firm Financials, Business and Culture, Business of Law

Episode 12. How do you talk to clients about money? Eight mini-interviews with lawyers across the country about a crucial law practice conversation.

Conventional wisdom is that there are really only two reasons that marriages end: sex and money. Sex with a client is frowned on and talking about it - except, perhaps as a part of the representation - is probably not a great idea. However, conversations with clients about money can be some of the most important conversations you have with them.

Unconventional Tools for Unconventional Times

I've had the luxury of being a member of interview panels for many entry level positions and I absolutely love it. If you set the right tone, ask the right questions, and make sure everyone is comfortable, you end up partaking in a great discourse as opposed to just slamming someone with questions. Because these entry level candidates just want a chance to prove themselves, you end up speaking with a number of creative and clever people. Inevitably the same question pops up in some form or another; "What are you looking for in a hire?"

Topics: Business and Culture, Business of Law

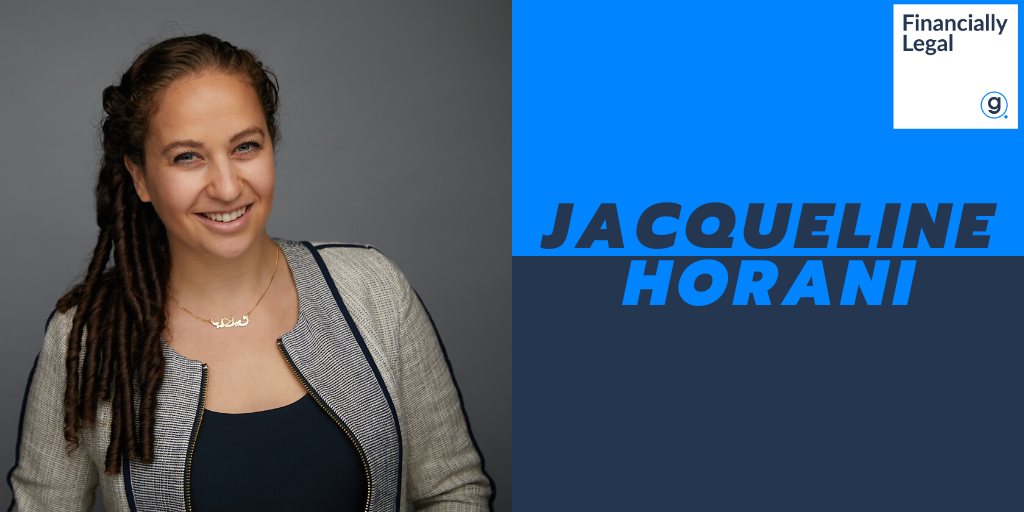

Episode 11. Can you build a sustainable values-based law firm and offer services to clients at an affordable rate? An interview with Jacqueline Horani from Legally Unconventional

Jacqueline Horani is a lawyer engaged in integrative consulting and plain language law in New York City. Inspired by the integrative law movement, Jacqueline is building a practice around conscious contracting, which focuses on identifying and integrating the parties’ values directly into the contracting process.

Credit Card Processing for Law Firms

Law firms are unique. They have unique processes and strange, sometimes archaic, rules governing the way to handle money. As a result, it's prudent for a law firm to ensure that any electronic payment processor understands and complies with these rules. Below are the most important items to check.

Topics: Credit Card Fees, Business of Law

How to Boost Collection Rates: Implement a Collect-Early Billing Model

Collection rate is defined as the revenue you actually collect into your operating bank account divided by the total amount invoiced. Typical collection rates for law firms are around 85%, but they vary markedly by firm. Increasing your collection rate is a great way to earn more without actually doing any additional work.

Topics: Firm Financials, Key Performance Metrics, IOLTA, Business of Law

Incubating The Future

Topics: Business and Culture, Confido Legal News

In Support of Civil Rights

In times like these we tend to turn to philosophers, poets, musicians, writers and artists for comfort and direction - wise minds that always have an answer for the trickiest of situations and the most uncertain of times. More specifically, Bob Dylan's "The Time They Are A-Changin'" seems more relevant now than ever.

Your old road is rapidly agin'

Please get out of the new one

If you can't lend your hand

For the times they are a-changin'

We at Confido Legal, while in full support of racial equity and civil rights, have taken a moment to reflect on what we could do to make a meaningful impact. We feel that stating our support accomplishes far less than action. Epictetus stated, "Don't explain your philosophy. Embody it."

Topics: Credit Card Fees, Civil Rights, Confido Legal News

Episode 10. What is the role of civil rights attorneys in the fight to rectify civil injustice? An interview with Geri Green and Cynthia Chandler

Geri Green and Cynthia Chandler have been fighting for marginalized individuals both in and out of courts for decades. In this episode of Financially Legal we talk about how and why, according to the 2019 Clio Trends report, civil rights attorneys bill for so little of their work (20% - the lowest of any practice area) and collect so little of what they bill (80% - third lowest).

Topics: Financially Legal Episodes

Dan Talks Law Firm Finances, Company Culture and More with Mark Homer of GNGF

Dan Lear was recently interviewed by Mark Homer of legal marketing firm GNGF. Dan and Mark dove into many different topics including:

- Company culture

- A $70,000 minimum wage

- The Confido Legal platform

- Law firm finance

- Alternative fee structures

- Expectations of the modern consumer of legal services

Topics: Firm Financials, Key Performance Metrics, IOLTA, Accounting, Business and Culture, Business of Law, Confido Legal News

Confido Legal's Dan Lear and Emery Wager Featured on Martindale-Avvo's Legal Tech Event

This week Dan Lear and Emery Wager joined Erin Levine of Hello Divorce and Liam Moriarty of Lawgood to talk the future Legal Tech.

Topics: Firm Financials, Key Performance Metrics, Business and Culture

Episode 9. A legal “plan?” What does that even mean? And why would you sell one to contractors? An interview with Seth Bloom from Levelset

Seth Bloom is the Sr. Director of Attorney Services at Levelset. If you’re not familiar with Levelset, it’s a company that helps all kinds of contractors, but particularly those in the construction space get paid and focus on what they like to do. It’s most relevant for legal professionals because those contractors often file, manage, and – when things go south - litigate liens. Enter Seth and the network of attorneys he’s building to help those construction professionals sort all of that out; but Seth's story doesn’t start there.

Topics: Financially Legal Episodes

Episode 8. Can you balance work and life? Should you even try? Is there anyone out there who can help you? An interview with Erin Giglia from Montage Legal Group

Erin Giglia is the Co-Owner of Montage Legal Group. As you’ll hear, Montage was founded more than a decade ago to exploit a “gap in the marketplace between freelancers and law firms.” Since then the model that Erin and her co-founder Laurie established has been emulated, adapted and admired by firms and freelance legal business across the legal sector.

Topics: Financially Legal Episodes

Simple Strategies To Cashflow Success For Your Law Firm (even during COVID)

Written By Devon Thurtle Anderson, CEO of Financial Consulting Firm, Skepsis

When I first left my law practice to become a law firm bookkeeper and financial strategist, I was shocked to discover how many law firms struggle with cashflow. Even more surprising was that this struggle isn’t just limited to a few seemingly rag-tag solo general practice firms. To the contrary, when I had a chance to look under the hood at dozens of law firms’ books and financial records – including law firms I had always seen as hugely successful – I learned that almost every law firm has a cashflow problem within any given 12-month period. So, as part of my bookkeeping and consulting services, I set out to change that.

Topics: Firm Financials, Credit Card Fees, Key Performance Metrics, IOLTA, Accounting, Invoices, Business of Law

Is Your Firm Ready for Re-entry?

Back in March I shared three things that I learned from the Small Law Firm Coronavirus Growth Symposium put on by How to Manage a Small Law Firm. At that time, when uncertainty and fear about our current predicament were at its peak, the content of the Growth Symposium offered a powerful reminder to stay positive and focused.

As the country begins, at least in some quarters, to open back up the good people from How To Manage a Small Law Firm are back with another program titled (in a very on-brand way) How to Not Screw Up Your Law Office’s Re-Entry.

Topics: Business and Culture, Business of Law

Episode 7. How do you “show up” for your clients? And what does a premium subscription have to do with that? An interview with Kim Bennett from K. Bennett Law

Kim Bennett got burned by hourly billing. She lost a bunch of money and, having come up as a young lawyer in a corporate, in-house role, the model didn’t make sense to her. One day she pitched a client on a recurring monthly fee and, to her surprise, they accepted. That’s right, we’re talking subscriptions again. But where the guest from our last subscription-based law practice, Jon Tobin, uses subscriptions in more of a "one-to-many" way, helping lots of clients with a specific set of offerings, Kim has fewer what she calls “premium” subscriptions and they include more comprehensive, regular work with the clients.

Topics: Credit Card Fees, Financially Legal Episodes, Accounting

The Most Important Things Lawyers Can Do in the Wake of COVID-19

By Dan Price

This article was originally published on the Attorney Action Club.

The COVID-19 pandemic has exacerbated the already terrible inequality we have in the United States. Prior to the outbreak, income inequality was the highest it had been in fifty years. Now, with more than 30 million people unemployed, it’s likely to get even higher for the foreseeable future.

Topics: Business and Culture, Business of Law

Two Ways Law Firms Can Reduce the Cost of Accepting Credit Cards

Credit cards are a great way to get paid more quickly. The Clio trends report shows that firms who accept credit cards get paid 39% faster than those that don't.

But credit cards are expensive. For invoice or trust payments where the client enters the card, rather than swiping or dipping, the cost generally hovers around 3%. Furthermore, credit cards are not the only way to provide a high-quality online payment experience.

Shopping around for better rates can save you a few tenths of a percent, but here are two changes you can make to drastically reduce card fees while still getting the benefit of speedy payments.

Topics: Firm Financials, Credit Card Fees, Business of Law

Episode 6. An episode about accounting? Really? An interview with Chelsea Williams from Core Solutions Group, Inc.

I know you didn’t go to law school to manage financials or be an accountant, but it turns out that your ability to successfully support and represent your clients is contingent upon running a sound business. And Chelsea Williams, founder and head of Core Solutions Group, is dropping some wisdom about how to manage your firm’s finances so that you can worry less about money and more about your clients.

Topics: Credit Card Fees, Financially Legal Episodes, Accounting

4 Steps to Effective A/R Management

Managing accounts receivable is important when times are good. But when times are tough, how effectively firms turn accounts receivable into cash can be the difference between going under and thriving.

Expert law firm financial consultant, Chelsea Williams of Core Solutions Group has an excellent video outlining four tips for effective accounts receivable management. Below is a summary, but we highly recommend checking out the video.

Topics: Firm Financials, Key Performance Metrics, Business of Law

Episode 5: Can you sell legal services by subscription? Should you? An interview with Jon Tobin from Counsel for Creators

Subscriptions services for a law-firm? It might be what your clients are looking for.

Jon Tobin is running one of the most innovative law firms you’ve never heard of. Counsel For Creators is an LA-based law firm for creatives and entrepreneurs that sells a subscription to clients. In this episode of Financially Legal we expand upon many of the topics we cover in our 5-part series about subscription legal services (which includes a number of shout-outs to Jon) and talk with Jon about the inspiration behind his subscription legal services plan, how he made it a reality, how (amazingly) it’s morphing into a profitable, self-sustaining community, how he calls his clients "members," and what’s next for his bold firm.

Episode 4: Can one small company change the world? Can one small law firm? An interview with Dan Price

Dan Price is a big deal. Full stop. And we got him on the podcast!

Dan is the inspirational CEO of Gravity Payments. In 2015 Dan raised the salaries of each of his employees at Gravity Payments to $70,000 annually and, in doing so, he became an overnight business celebrity. He’s been on the Today Show, been interviewed by Trevor Noah, and keynoted hundreds of business conferences around the world. He breaks down how he thinks about company culture, why Gravity Payments is investing in Confido Legal, and how he thinks lawyers can change the world.

Three Things I Learned from the HTM Coronavirus Growth Symposium and Why You Should Attend

Starting back on March 23, RJon Robins of How To Manage a Small Law Firm held a series of free daily phone conversations with lawyers in response to the coronavirus/COVID-19 pandemic. RJon was his typically direct but his message was hopeful: there is opportunity out there for lawyers and law firms .

Topics: Firm Financials, Business of Law, Confido Legal News

Confido Legal's Dan Lear Featured on the Clio Daily Matters Podcast

In this episode of Clio Matters, Dan discusses different ways firms are navigating the new remote work environment. He lists helpful technology resources and tells us whose ideas he's leaning on amidst the chaos (Nate Silver and RJon Robins of How to Manage a Small Law Firm to name a few).

Topics: Firm Financials, Credit Card Fees, Key Performance Metrics, IOLTA, Confido Legal News

Episode 3: Why do trust accounts even exist? And why should we care?

We get nerdy this episode talking accounting, trust accounting, and regulatory jazz with Lainie Hammond. Lainie runs a law firm in Washington State helping lawyers with issues related to IOLTA trust account compliance.

Topics: Firm Financials, Financially Legal Episodes, IOLTA

Five Ways to Shore Up Your Law Firm's Finances Now

Our lives and livelihoods have changed dramatically over the last two weeks. We’re all hopeful for a swift and significant rebound, but proactive measures will carry the day. Action in crisis can provide a feeling of purpose and normalcy amidst the potentially overwhelming uncertainty. It can also be the difference between going under and thriving.

Topics: Firm Financials, Credit Card Fees, Business of Law

State Rules on Charging Clients a Fee for Paying With Credit Cards

There are three sets of rules lawyers need to navigate when deciding whether to charge clients a fee for paying with a credit card:

Topics: Firm Financials, Credit Card Fees, Business of Law

Covid 19 Financial Resources for Firms and Their Clients

Whether your firm is in need of financial assistance or you are working to advise clients through these difficult times, we've compiled a list of local, state and national Covid 19 financial relief programs.

Topics: Firm Financials, Business of Law

Episode 2: The Agile Attorney

Today, we're excited to have a conversation with John E. Grant, the Agile Attorney. John is a compelling thinker when it comes to law firm economics, law firm efficiency, and law firm productivity.

Topics: Firm Financials, Financially Legal Episodes, Key Performance Metrics

Search Financially Legal

Posts by Tag

- Business of Law (171)

- Firm Financials (78)

- Financially Legal Episodes (69)

- Accounting (55)

- Surcharging (52)

- Business and Culture (37)

- Confido Legal News (32)

- Product Updates (17)

- Credit Card Fees (15)

- Legal Case Management (11)

- Subscriptions (10)

- Key Performance Metrics (9)

- IOLTA (6)

- Integrations (6)

- Lawyer Communities (5)

- Zapier (3)

- Payments (2)

- QuickBooks (2)

- QuickBooks Integration (2)

- Stored Payment Methods (2)

- Apple Pay (1)

- Civil Rights (1)

- Clients (1)

- Fidu (1)

- Flat Fee Billing (1)

- GPay (1)

- Invoices (1)

- Payment Methods ,Subscriptions (1)

- Payment automation (1)

- Venmo (1)

Get the Latest from Financially Legal

-2.png)

-1.png)