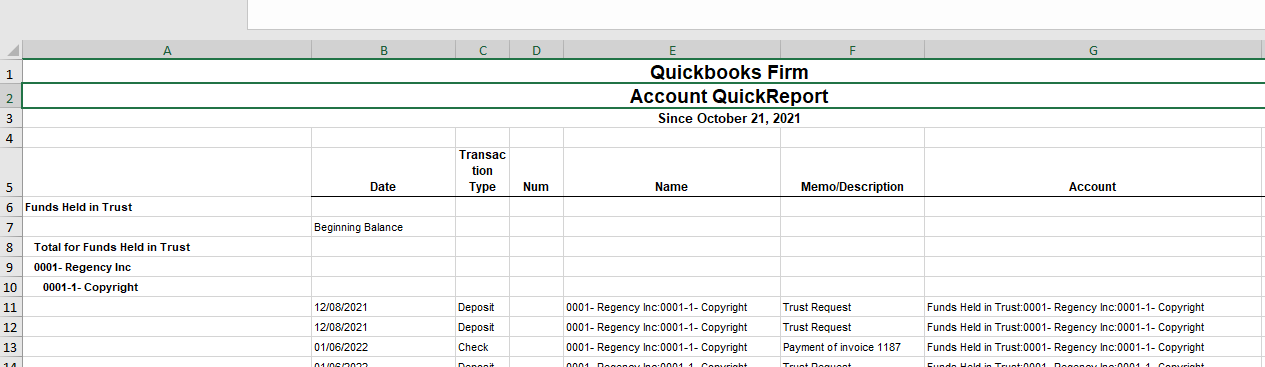

Millions of business use QuickBooks as their accounting platform. From sole proprietors to large corporations, from cobblers to manufacturing firms, QuickBooks users come from all corners of the business world. With QuickBooks serving such a diverse set of clients, there are certain industries and business types with unique accounting needs that QuickBooks doesn't fully support out-of-the-box. Law firms fit into this category.

Financially Legal is a podcast for law firm CFOs dealing with financial aspects of the business of law. Host, Emery Wager, talks with law firm leaders, academics, business professionals and thought leaders to provide compelling and provocative insights at the intersection of finance, economics, and law.

QuickBooks for Lawyers and Law Firms

Topics: Accounting, QuickBooks Integration, QuickBooks, Business of Law

Dan Talks Law Firm Finances, Company Culture and More with Mark Homer of GNGF

Dan Lear was recently interviewed by Mark Homer of legal marketing firm GNGF. Dan and Mark dove into many different topics including:

- Company culture

- A $70,000 minimum wage

- The Confido Legal platform

- Law firm finance

- Alternative fee structures

- Expectations of the modern consumer of legal services

Topics: Firm Financials, Key Performance Metrics, IOLTA, Accounting, Business and Culture, Business of Law, Confido Legal News

Simple Strategies To Cashflow Success For Your Law Firm (even during COVID)

Written By Devon Thurtle Anderson, CEO of Financial Consulting Firm, Skepsis

When I first left my law practice to become a law firm bookkeeper and financial strategist, I was shocked to discover how many law firms struggle with cashflow. Even more surprising was that this struggle isn’t just limited to a few seemingly rag-tag solo general practice firms. To the contrary, when I had a chance to look under the hood at dozens of law firms’ books and financial records – including law firms I had always seen as hugely successful – I learned that almost every law firm has a cashflow problem within any given 12-month period. So, as part of my bookkeeping and consulting services, I set out to change that.

Topics: Firm Financials, Credit Card Fees, Key Performance Metrics, IOLTA, Accounting, Invoices, Business of Law

Episode 7. How do you “show up” for your clients? And what does a premium subscription have to do with that? An interview with Kim Bennett from K. Bennett Law

Kim Bennett got burned by hourly billing. She lost a bunch of money and, having come up as a young lawyer in a corporate, in-house role, the model didn’t make sense to her. One day she pitched a client on a recurring monthly fee and, to her surprise, they accepted. That’s right, we’re talking subscriptions again. But where the guest from our last subscription-based law practice, Jon Tobin, uses subscriptions in more of a "one-to-many" way, helping lots of clients with a specific set of offerings, Kim has fewer what she calls “premium” subscriptions and they include more comprehensive, regular work with the clients.

Topics: Credit Card Fees, Financially Legal Episodes, Accounting

Episode 6. An episode about accounting? Really? An interview with Chelsea Williams from Core Solutions Group, Inc.

I know you didn’t go to law school to manage financials or be an accountant, but it turns out that your ability to successfully support and represent your clients is contingent upon running a sound business. And Chelsea Williams, founder and head of Core Solutions Group, is dropping some wisdom about how to manage your firm’s finances so that you can worry less about money and more about your clients.

Topics: Credit Card Fees, Financially Legal Episodes, Accounting

Can Law Firms Charge Clients for Credit Card Fees in Oklahoma?

Introduction

The short answer is yes, but there are certain rules and regulations to understand, including a 2% cap on the amount as of November 2025.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in West Virginia?

Introduction

The short answer is probably not. See below for all the details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Tennessee?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in North Dakota?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Nebraska?

Introduction

The short answer is maybe, but probably not. See below for details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Montana?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Missouri?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Mississippi?

Introduction

The short answer is probably not. See below for all the details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Minnesota?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Michigan?

Introduction

The short answer is probably not. See below for all the details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Maine?

Introduction

The short answer is not unless it is done by raising prices by the amount of the charge and then discounting those prices for clients that pay by means other than card. Below are more details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Louisiana?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Kentucky?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Kansas?

Introduction

The short answer is not unless it is done by raising prices by the amount of the charge and then discounting those prices for clients that pay by means other than card. Below are more details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Iowa?

Introduction

The short answer is maybe, but probably not. See below for details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Indiana?

Introduction

The short answer is maybe, but probably not. See below for details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Delaware?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Arkansas?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Alaska?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Alabama?

Introduction

The short answer is probably not. See below for all the details.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Wyoming?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Wisconsin?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Vermont?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Virginia?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Can Law Firms Charge Clients for Credit Card Fees in Utah?

Introduction

The short answer is yes, but there are certain rules and regulations to understand.

Topics: Firm Financials, Accounting, Surcharging, Business of Law

Search Financially Legal

Posts by Tag

- Business of Law (171)

- Firm Financials (78)

- Financially Legal Episodes (69)

- Accounting (55)

- Surcharging (52)

- Business and Culture (37)

- Confido Legal News (32)

- Product Updates (17)

- Credit Card Fees (15)

- Legal Case Management (11)

- Subscriptions (10)

- Key Performance Metrics (9)

- IOLTA (6)

- Integrations (6)

- Lawyer Communities (5)

- Zapier (3)

- Payments (2)

- QuickBooks (2)

- QuickBooks Integration (2)

- Stored Payment Methods (2)

- Apple Pay (1)

- Civil Rights (1)

- Clients (1)

- Fidu (1)

- Flat Fee Billing (1)

- GPay (1)

- Invoices (1)

- Payment Methods ,Subscriptions (1)

- Payment automation (1)

- Venmo (1)

Get the Latest from Financially Legal