Millions of business use QuickBooks as their accounting platform. From sole proprietors to large corporations, from cobblers to manufacturing firms, QuickBooks users come from all corners of the business world. With QuickBooks serving such a diverse set of clients, there are certain industries and business types with unique accounting needs that QuickBooks doesn't fully support out-of-the-box. Law firms fit into this category.

There are two primary questions law firms using QuickBooks often need to answer:

- How to accept credit card or ACH payments into a trust or IOLTA account?

- How to account for funds held in trust using QuickBooks?

The good news is with hundreds of apps in the QuickBooks app store, there are effective ways to overcome these challenges and make QuickBooks a great option for handling law firm accounting. In this article we'll cover answers to these two questions.

How to Accept Credit Card or ACH Payments into a Trust or IOLTA Account in QuickBooks?

QuickBooks payments can be a good option for sending an invoice and receiving payment on that invoice, but as lawyers know, it's not always enough to accept payments into the operating account. With the ability to link only one payment processing account to each QuickBooks account, there isn't a way to accept payments into a trust account using QuickBooks payments without significant technical and accounting gymnastics.

Here are three paths we've seen firms take to overcome this limitation:

- Find a payment processor that can manage fees in accordance with the rules of professional conduct and that understands the business of law. Use this processor to accept payments outside of QuickBooks and then manually record those payments in QuickBooks.

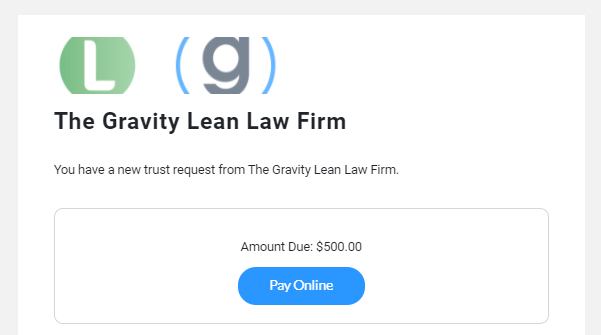

- Use the Confido Legal QuickBooks integration to send trust deposit requests to clients. Payments made on those requests are automatically posted to the trust account in QuickBooks (more on this below).

- Use a legal-specific practice management system that allows for acceptance of electronic trust payments and separately integrates with QuickBooks. Lawcus, LeanLaw and Matter365 are good examples of this.

How to Do Trust Accounting in QuickBooks

Since QuickBooks was not specifically designed for the unique way lawyers and law firms accept, hold and account for client funds, there are a few workarounds needed to effectively account for money held in a trust or IOLTA account.

Below are the two ways we've seen firms account for funds held in trust and produce three-way reconciliation reports:

Account for Funds Held in Trust Using Only the Customer Records in QuickBooks

In this model, law firms create a single trust liability account in QuickBooks and use the customer records to account for transactions and balances by client. Below are the typical steps:

Setup:

- Create a trust liability account in the QuickBooks chart of accounts.

- Create a trust bank account in the QuickBooks chart of accounts.

- Add starting balances to the liability account and the bank account by QuickBooks customer.

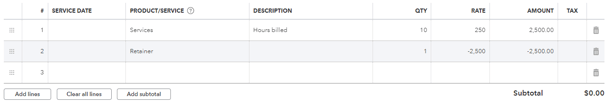

- Create a product in QuickBooks that you will use to record any funds from trust that will be applied to invoices. Associate that product with your newly-created trust liability account.

Recording Trust Deposits and Paying Invoices from Funds in Trust:

- Record payments into trust as deposits associated with the particular QuickBooks customer. Each deposit should be associated with both your trust liability account and trust bank account.

- When these fees are earned, add the product you created in step D above to the invoice and enter the amount of funds from trust you want to apply to the invoice. Make sure to make this amount negative, so it brings down the outstanding amount of the invoice.

- Once the invoice is paid (or immediately after creation if the outstanding balance is $0), the trust liability account will be decreased by the amount of trust funds applied to that invoice.

- Record an associated transfer in QuickBooks from your trust bank account to you operating bank account.

- Go to your bank and transfer the money (or use Confido Legal).

- The trust bank account balance in QuickBooks should now match your trust liability account balance.

- To export a report of trust balances by client, navigate to the trust liability account and select "Run Report." Click "Customize" and make sure the date range is set to All Dates and the Rows/Columns are grouped by Customer. This will provide a balance by client for the trust account. Name this report, so you can generate it in the future without having to customize it every time.

Under this model of trust accounting, using just the Confido Legal integration with QuickBooks to accept payments typically works well, since each payment is associated with a QuickBooks customer and automatically recorded in the liability and bank accounts in QuickBooks.

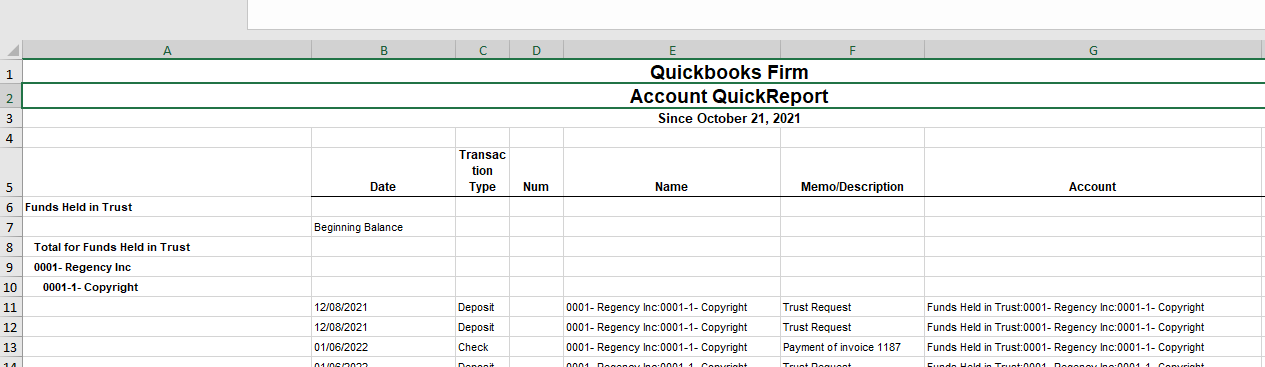

Account for Funds Held in Trust Using QuickBooks Sub Accounts

The second model of trust accounting uses sub accounts in QuickBooks to manage the client balances held in trust.

In this model, you still create the trust bank and liability accounts as outlined in the prior model, but you also create sub accounts for each client (and optionally matter) in QuickBooks nested under your main trust liability account.

Create starting balances in each sub account and add future payments as deposits, not to the top-level liability account, but to the particular client/matter sub account.

This can be a good fit if your requirements are more complex and you need greater flexibility in how client records are managed. Keep in mind QuickBooks charges more if you surpass a certain number of accounts, so it's important to know these limits and choose your accounting model accordingly.

If you are using this model, there are a few options to use credit card and ACH payments to make this process easier:

- Use either LeanLaw or Matter365 to automate the process of creating and depositing payments into your sub liability accounts. By sending trust requests directly through these systems, all payments made on those requests are atomically added to the proper sub liability account in QuickBooks.

- Use the Confido Legal QuickBooks integration. In this case, all trust payments are automatically recorded by client into the top-level trust liability account. This is a nice first step, but keep in mind, each deposit will need to be manually "dragged down" into the proper sub liability account.

Using these processes and systems, law firms can leverage the power of QuickBooks while navigating the issues around accepting and accounting for payments into a trust or IOLTA account.

If you would like to see any of these integrations in action, use the link below to schedule a demo.

If you need professional help setting up your accounting systems and ensuring your books are in order, reach out to us. We partner with some amazingly talented accountants who know the systems and processes mentioned in this article and work exclusively with law firms.