In this special series focused on legal case management software, host Dan Lear explores various case management companies to help firms make informed decisions. In this episode, Dan speaks with Harsimran Singh, Founder and CEO of Lawcus. Lawcus offers a comprehensive solution, combining legal practice management, client relationship management (CRM), client intake, and no-code automation, all unified in a single platform.

Financially Legal is a podcast for law firm CFOs dealing with financial aspects of the business of law. Host, Emery Wager, talks with law firm leaders, academics, business professionals and thought leaders to provide compelling and provocative insights at the intersection of finance, economics, and law.

Episode 49: Legal Case Management Series - An Interview with Harsimran Singh of Lawcus

Episode 48: Legal Case Management Series - An Interview with Dov Slansky of Litify

In this special series focused on legal case management software, host Dan Lear explores various case management companies to help firms make informed decisions. In this episode, Dan speaks with Dov Slansky, Vice President of Strategy and Innovation at Litify, a legal operating solution that helps law firms, in-house legal departments, and government agencies run smarter.

Episode 47: Legal Case Management Series - An Interview with Dragana Milovanovic of Matter365

In this special series focused on legal case management software, host Dan Lear explores various case management companies to help firms make informed decisions. In this episode, Dan speaks with Dragana Milovanovic from Matter365, a user friendly cloud solution that fully integrates all data from Microsoft Office 365 applications into a matter-centric environment. With powerful add on features and Microsoft 365 applications, Matter365 is one of the most comprehensive solutions on the market today.

Episode 46: Legal Case Management Series - An Interview with Jonathon Fishman, CEO of LeanLaw

In this special series focused on legal case management software, host Dan Lear explores various case management companies to help firms make informed decisions. In this episode, Jonathon Fishman, CEO of LeanLaw, shares insights about their financial operating system designed for small to medium-sized law firms.

Confido Legal Talks Accounts Receivable for Law Firms on CPA Academy

Recently, Confido Legal teamed up with CPA Academy to host an informative webinar on optimizing accounts receivable and collections processes for law firms. This session provided practical strategies and tools to improve collection rates and streamline cash flow. With a focus on the Collections Optimizer, participants explored various billing models and table stakes items that contribute to enhanced collection rates. In this blog post, we'll delve into the highlights from the webinar and uncover the valuable insights shared.

Topics: Business of Law, Confido Legal News

Confido Legal and QuickBooks Team Up to Streamline Payment Processing for Law Firms

We are excited to announce that Confido Legal has teamed up with QuickBooks, the leading small business accounting platform, by formally joining the QuickBooks Solution Provider Program. In combination with Confido Legal’s QuickBooks integration - the only legal-specific payments integration in the QuickBooks store - Confido Legal and QuickBooks are truly better together.

Topics: QuickBooks Integration, Business of Law, Integrations, Confido Legal News

Testing Out Confido Legal and ChatGPT

Today we spent some time testing the new plugins feature for ChatGPT. Specifically, we took a look at the Zapier plugin, which allows you to connect thousands of apps and their Zapier Actions to ChatGPT. Of course, we used the Confido Legal Zapier Actions as our test case.

Topics: Business of Law, Confido Legal News

Embedded Subscription Payments Live in Fidu

As we continuously expand the value and power of Fidu, we are thrilled to announce a strategic partnership with Confido Legal, an innovative payment processing and money management solution for law firms. This partnership was unveiled at the American Bar Association Technology Show held in Chicago.

Topics: Business of Law, Integrations

The Power of Measuring Your Law Firm’s Return on Investment (ROI)

If you invest a dollar into your law firm, what do you expect to get back?

Why is the answer to this question so important? It helps you decide what initiatives to pursue and what initiatives to cut. It also tells you whether you are building the right financial opportunity for yourself and your partners. If you are only getting a dollar out for every dollar you put in, you’d be better off keeping that dollar. If this is the case, it’s time to rethink the firm’s strategy and take a closer look at the financial “leaks” in the business.

Topics: Business of Law

The Dangers of Accepting Wire Transfers at Your Law Firm

Wire transfers are a common method of accepting payments for law firms, but they can be risky for both your firm and your clients. This article outlines the dangers and downsides associated with accepting wire transfers and best practices for avoiding these traps.

Topics: Business of Law

Should a Law Firm Hire a Collections Agency?

The two most controversial topics for law firms related to client payments and collections are:

- Should law firms charge credit card fees to clients?

- Should law firms hire a collections agency to recoup long outstanding accounts receivable?

We have published substantial information to help you make a decision on on whether to charge card fees to clients but very little on navigating the collections agency conundrum.

Topics: Business of Law

The Law Firm Third-Party Client Finance Decoder

We at Confido Legal strongly believe that firms and clients benefit most when firms offer clients a variety of options to pay. Firms invest significant dollars to get clients in the door. It’s a waste of those resources to have a would-be paying client walk out the door simply because the firm doesn’t offer payment plans (i.e. doesn’t want to be the client’s bank), the client doesn’t have a credit card, or because the firm won’t offer third-party funding.

Topics: Business of Law

Buy Now, Pay Later for Legal: What, Why, and How

Over the last few years there’s been an explosion of third-party commercial financing options. Familiarly known as “Buy Now, Pay Later” and offered by companies like Klarna, Affirm, and Sunbit, these services provide short-term loans to consumers to purchase everything from furniture to event tickets.

Topics: Business of Law, Clients

Database of Collections Agencies for Law Firms

The decision to hire a collections agency is a difficult one, and although most law firms are collections curious, the majority of firms we talk to have not hired one. That said, the feedback from law firms who have hired an agency is pretty darn positive.

Topics: Business of Law

Episode 45. What does it take to get a collections rate of 95% and how does that intersect with diversity, transparency, and compensation? An interview with Jim Meadows from Culhane Meadows

How, if at all, do compensation, diversity, and transparency overlap? How can these competing priorities be reconciled? Jim Meadows from Culhane Meadows doesn’t have the perfect answer. But he’s giving it a solid try.

Episode 44. How do creativity and analytics blend to grow a contingency law firm? An interview with Lynn Bradley from The Potts Law Firm

Plaintiffs' lawyers are often bold, brash, larger-than-life characters with billboards, regular TV ads, and ambition to match.

But they're also visionary creatives. They excel at building something from nothing and carving out a new and unique path for legal professionals - often where no path existed before. But that creativity needs to be leavened with stability and more strategic thinking.

Join Legendary 'No B.S.' Business Leader Dan Kennedy for an Exclusive Interview

If you don't know who Dan Kennedy is, you should. Here's just a quick recap of the impact he's had on the business world in his 30+ year career:

Topics: Business of Law

How Immigration Law Firms Automate Payment Plans with QuickBooks

Immigration law firms have unique billing practices. Most immigration firms we encounter either predominantly or exclusively put clients on payments plans. These plans involve the client entering their payment information so they can be automatically billed on a regular schedule until a specified dollar amount is reached.

Topics: Business of Law

Compliant Surcharging: Credit? Yes. Debit? Not so fast.

One of our most popular features at Confido Legal is our compliant surcharging, enabling firms to shift credit card processing fees to their clients. When we talk with firms, many are surprised to learn that it's against some state laws and the card brand rules for businesses, including law firms, to surcharge on debit cards. A smaller group is not just surprised but a bit concerned because they've been shifting card fees on debit cards unknowingly.

In this blog post, we break down the reasons why surcharging on debit card transactions is impermissible and the implications of these restrictions for law firms.

Topics: Surcharging, Business of Law

The Legal Ethics of Trust-less Retainers

One of our most popular blog posts is a post about how lawyers can realize the benefits of a retainer without a trust account. By storing a client payment method and subsequently charging the payment method in accordance with the attorney/client engagement agreement, firms can get the benefits of having access to funds on hand without the burden of trust account compliance.

Topics: Business of Law, Payments

The Collections Optimizer

Topics: Business of Law

Trust Accounting in Confido Legal

Do you have practice management or accounting software that does your trust accounting? Great. This post is NOT for you.

Topics: Business of Law

Do You Write Checks...to Yourself?

Let's face it. Most bankers have no idea what an IOLTA account is. These types of accounts are an afterthought - one of those banking products that gets little attention. We hear horror stories of banks regularly debiting fees from IOLTA accounts or sending erroneous overdraft notifications to the Bar. We recently spoke to a firm that had to call their bank to speak with a real live human being every time they wanted to check their IOLTA balance.

Topics: Business of Law

Financing for Law Firms Now Available Through Confido Legal

We believe lawyers and law firms have the power to change the world. Every day we interact with lawyers making positive change, sticking up for the underdog and expanding access to the justice system. But we recognize there can be tradeoffs between pursuing these aims and paying the bills.

Topics: Business of Law, Confido Legal News

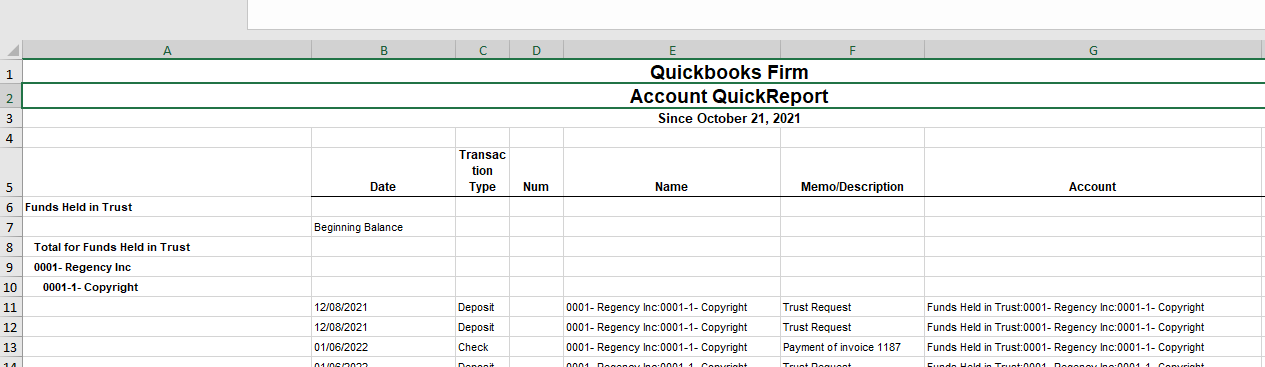

QuickBooks for Lawyers and Law Firms

Millions of business use QuickBooks as their accounting platform. From sole proprietors to large corporations, from cobblers to manufacturing firms, QuickBooks users come from all corners of the business world. With QuickBooks serving such a diverse set of clients, there are certain industries and business types with unique accounting needs that QuickBooks doesn't fully support out-of-the-box. Law firms fit into this category.

Topics: Accounting, QuickBooks Integration, QuickBooks, Business of Law

Retainers Without the Trust Account - Payments on File for Law Firms

Trust or IOLTA accounts evoke feelings of fear and frustration. Untangling trust accounting mistakes can devour precious hours, and the risk of running afoul of the rules of professional conduct is constant. Yet for all the bad, retainers (in particular evergreen retainers) are one of the top ways to improve your firm’s collection rate. With collection rates averaging around 85% according to the 2021 Clio Trends Report, collections is a major financial drain on the legal industry.

Topics: Business of Law

How to Dispute a Chargeback for Law Firms

Whether a client unilaterally decided not to pay your firm, or you made a legitimate mistake in your billing process, disputes or chargebacks on credit card transactions do occur. The card brands have processes in place for settling these disputes, and this article outlines the actions your firm can take after receiving notice of a chargeback. For information on how to avoid chargebacks, see How to Protect Your Law Firm from Chargebacks.

Topics: Business of Law

Confido Legal - Now Available in the Reynen Court Solution Store

Vetting, deploying, and managing new technology takes a lot of time and can be expensive. More to the point, while much of today’s cloud computing technology uses some common technologies, the implementation can vary significantly even in the cloud. This can be a real headache for law firms who not only often deal with sensitive information but have specific rules and heightened standards regarding how confidential and privileged information must be protected.

Topics: Business of Law, Confido Legal News

Can Bankruptcy Lawyers Accept Credit Cards?

You can’t really blame consumer bankruptcy attorneys for being finicky about how they get paid. After all, would-be clients wouldn’t be knocking on the door if the those debtors had managed their money well and been able to regularly pay their debts. As a result, many bankruptcy attorneys do way more gymnastics than other lawyers to ensure they get paid. For example, insisting upon upfront payment, payment by the debtor’s friends or family, automated payments that fall on a debtor-client’s payday, or even the development of a new type of bankruptcy, bifurcated bankruptcy, that changes how clients pay in order to improve their odds of getting paid (we won’t get into bifurcated bankruptcy here but watch this space for a subsequent post on the topic). You’ve got to hand it to them.

Topics: Business of Law

Beyond Credit Cards: 3 Quick Tips to Optimize Payments at Your Law Firm

Listen, we here at Confido Legal work hard for the money we get paid. Payments isn’t as mentally straining as rocket science or physically demanding as coal mining but it is a fairly complex regulated business and we work really hard to try and make things great for our law firm customers. And while there are still a handful of bar associations that want to make it harder for law firms to accept electronic payments (we’re looking at you Indiana, Iowa, Mississippi, Nebraska, West Virginia, Alabama, and Michigan), today most law firms are largely free to take advantage of the collections and convenience benefits that accepting electronic payments offers.

Topics: Business of Law

Search Financially Legal

Posts by Tag

- Business of Law (171)

- Firm Financials (78)

- Financially Legal Episodes (69)

- Accounting (55)

- Surcharging (52)

- Business and Culture (37)

- Confido Legal News (32)

- Product Updates (17)

- Credit Card Fees (15)

- Legal Case Management (11)

- Subscriptions (10)

- Key Performance Metrics (9)

- IOLTA (6)

- Integrations (6)

- Lawyer Communities (5)

- Zapier (3)

- Payments (2)

- QuickBooks (2)

- QuickBooks Integration (2)

- Stored Payment Methods (2)

- Apple Pay (1)

- Civil Rights (1)

- Clients (1)

- Fidu (1)

- Flat Fee Billing (1)

- GPay (1)

- Invoices (1)

- Payment Methods ,Subscriptions (1)

- Payment automation (1)

- Venmo (1)

Get the Latest from Financially Legal

-1.png)

.png)

-2.png)

-Dec-05-2022-12-46-13-3404-AM.png)

.png)

-1.png)