Does Confido Legal hold onto the surcharge fees?

This article outlines what happens to fees paid by clients.

Confido Legal does not hold onto the surcharge fees. All surcharging fees get deposited into your operating account. At the end of the month, the fees are withdrawn from your operating account as part of monthly billing.

Prerequisites

- Surcharging must be enabled for your firm.

Accounting for Fees

- For payments to your operating account, the surcharge fee is simply added to the total payment.

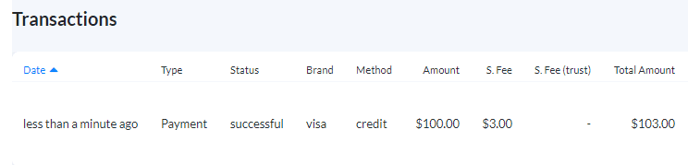

- A client owes $100 and pays with a credit card, incurring a $3 fee. The client will see one transaction for $103 on their credit card statement. And $103 will be deposited to your operating account. This payment will be displayed in Reports like this:

- A client owes $100 and pays with a credit card, incurring a $3 fee. The client will see one transaction for $103 on their credit card statement. And $103 will be deposited to your operating account. This payment will be displayed in Reports like this:

- For payments to your trust account, the payment is deposited to trust while the surcharge fee is deposited to your operating account.

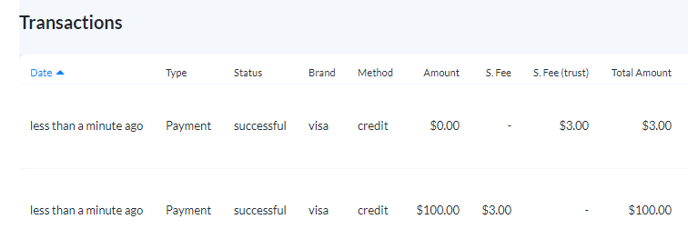

- A client pays a trust request of $100 with a credit card, incurring a $3 fee. The client will see two transactions on their credit card statement ($100, $3). And $100 will be deposited to your trust account while $3 is deposited to your operating account. It will appear in Reports like this:

- A client pays a trust request of $100 with a credit card, incurring a $3 fee. The client will see two transactions on their credit card statement ($100, $3). And $100 will be deposited to your trust account while $3 is deposited to your operating account. It will appear in Reports like this:

- For split operating/trust payments, all fees will be added to the operating portion of the transaction.

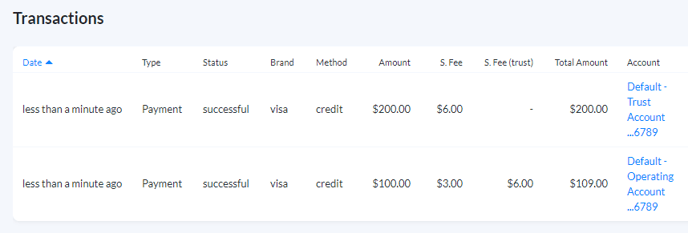

- A client makes a $300 payment, $200 is designated for the trust account and $100 for the operating account. The client will see two transactions on their credit card statement ($200, $109).

- $200 to the trust account

- $109 to the operating account

- $100 amount due

- $3 surcharge fee for the operating payment

- $6 surcharge fee for the trust payment

- A client makes a $300 payment, $200 is designated for the trust account and $100 for the operating account. The client will see two transactions on their credit card statement ($200, $109).