What should I know before surcharging?

This article outlines the rules for surcharging and what to be aware of prior to passing fees on to clients.

Prerequisites

- Surcharging is designed to comply with applicable rules and regulations. For a more detailed look at these rules, see our surcharging guide by state.

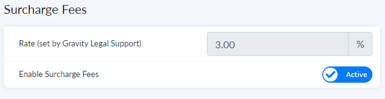

- Your firm must be enabled for surcharging by Confido Legal.

- If you do not see this option in Settings > Firm Settings, contact support@confidolegal.com to enable surcharging.

Card Brand Rules

- Notify Visa & Mastercard of your intent to surcharge. Confido Legal notifies them on your behalf so you don't need to do any additional work.

- When refunding payments where the client originally paid the surcharge fee, you will also need to refund the fee amount. In the event of a partial refund, the fee refund should be prorated.

- Do not apply a surcharge to debit card payments. Confido Legal will only apply surcharges to confirmed credit card payments.

- Inform the client of the surcharge amount prior to the client completing the payment. This is covered by Confido Legal's statement on each payment page.

Other things to consider

- All surcharged fees will be deposited to your operating account and will be withdrawn at the end of the month as part of normal fee billing.