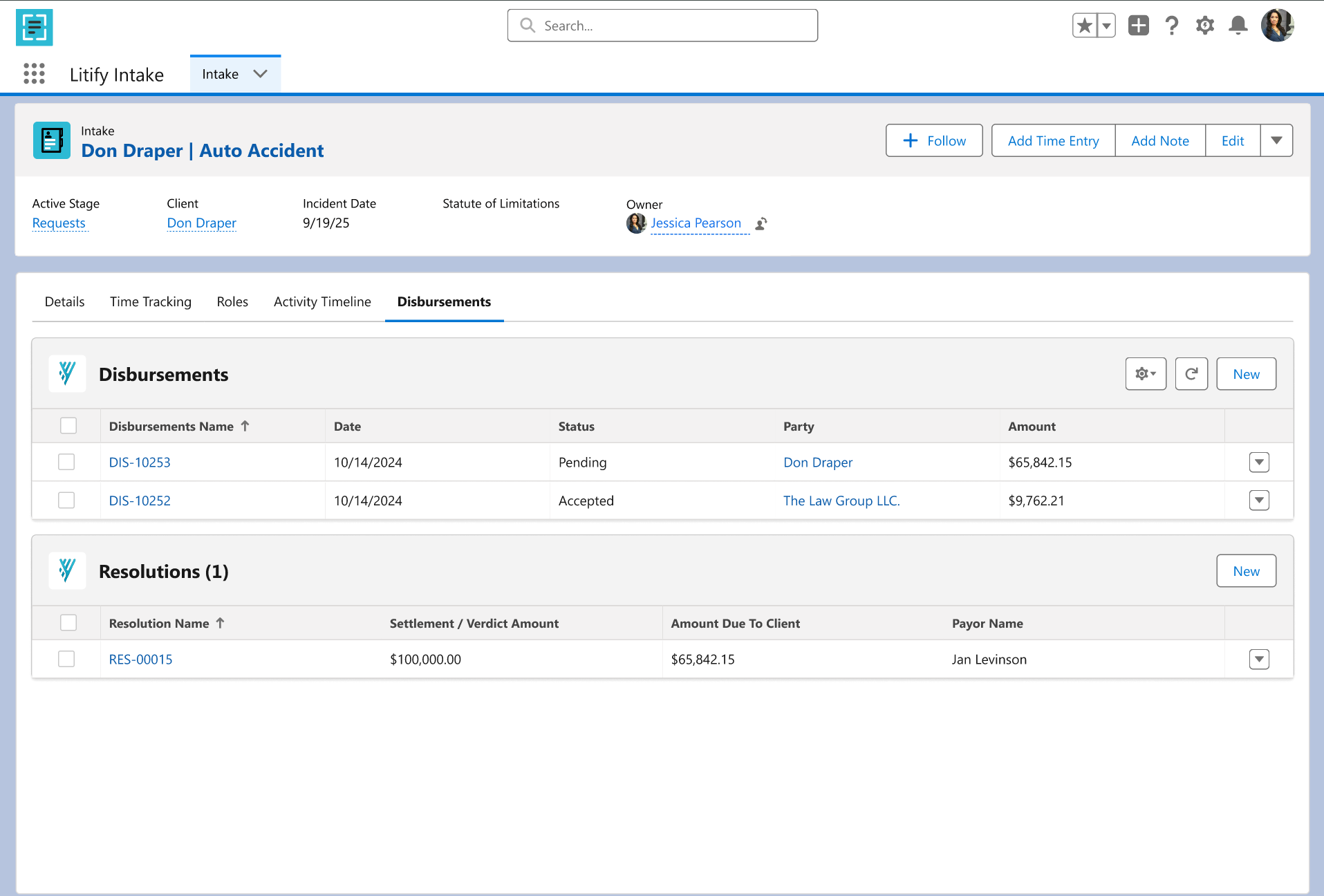

Litify Disbursements powered by Confido Legal allows you to send money instantly to clients, lienholders, and more directly from Litify.

Queue, approve and track disbursements to clients and third parties in personal injury, workers' compensation and mass tort cases, ensuring the right funds go to the right person every time.

Payment Methods for the Next Generation of Clients

The next generation of clients don't want to wait for a check or deal with cashing it. Disburse funds to clients into wallets like Paypal and Venmo or direct to a client's bank account using their debit card.

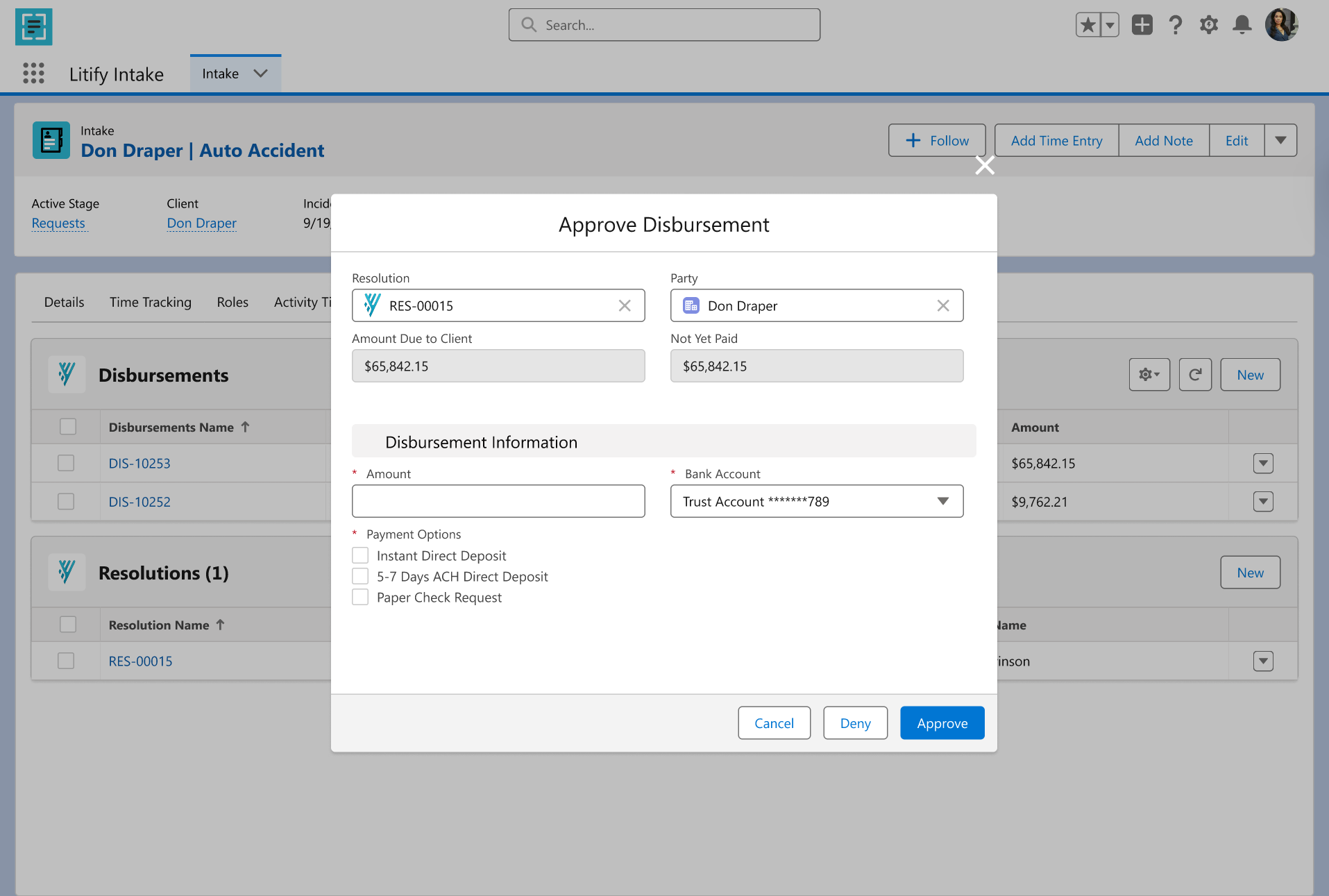

Integrated with Litify

Initiate, approve and manage disbursements directly in Litify to keep client records up to date and remove the need for duplicate entry. Automtically create Litify Transactions from disbursements to integrate with third-party accounting systems.

Don't Wait for the Client to Cash the Check

Tired of accounting for money sitting in your trust account for months while you wait for clients to cash their disbursement checks?

With Litify Disbursements, funds are automatically debited from the selected firm bank account and sent to the recipient's bank account.

Go Paperless

No postage, no envelopes, no mailboxes. Upload plaintiff contact information and manage all disbursements directly in Litify.

Implement Financial Controls and Disbursement Attribution

Control who has access to approve disbursements. Allow your team to queue all disbursements, giving you the ability to simply review and approve each disbursement or the entire queue.

Disburse to Unbanked Clients

Digitally issue stored value cards to clients who don't have access to a bank account.

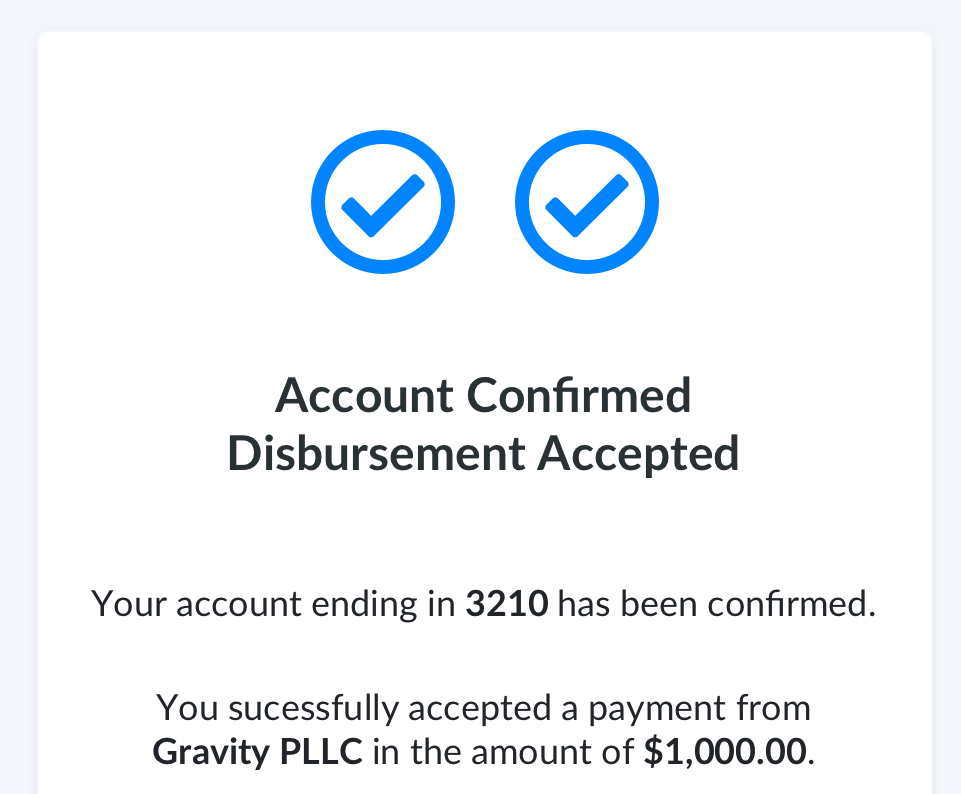

We support sending disbursements by ACH and push-to-card. Push-to-card allows the recipient to accept disbursements into their bank using their debit card, and funds are available in seconds or minutes.

More payment methods are launching soon.

The recipient may choose a free-to-them payment method like ACH, which will deposit their funds in 5-7 days.

The recipient may choose to pay a small fee to receive their funds in seconds or minutes.

Yes, we will set specific limits on your account. Our goal is to work with you to support the disbursement volume you need while managing our financial risk.

Transaction limits will vary based on the method of disbursement.

On the recipient side of the transaction, we use multifactor authentication. Only someone with access to the client's email and phone can unlock the disbursement. Disbursements are sent using non-indexed, secure links to prevent unauthorized access to the authentication step.

On the firm side, when creating the transaction, only administrators on your Confido Legal account may approve disbursements.

In addition, firms may enable Confido's Enhanced Security on certain transactions. Enhanced Security is our proprietary layer of additional verification, specifically designed to prevent someone with inside access to the plaintiff's personal information from accessing the money.

Clients have the option to log in to their online banking platform through Plaid to accept the disbursement. This helps reduce the chances that a client will enter incorrect banking information.

In addition, entering incorrect banking information will typically result in an ACH return from the recipient's bank, at which point the disbursement link will reactivate and the funds will be returned to your firm's bank account.

Our disbursements platform was built with the rules of professional conduct in mind. Several key aspects of the platform ensure you comply with the ethics rules in your state:

- Although any user in your Confido Legal account can create draft disbursements, an administrator on the account must approve each disbursement for money to move and your trust account to be debited. This gives you the power to decide who can approve disbursements.

- We track who at your firm drafted and approved each disbursement for your recordkeeping purposes.

- Each disbursement in Confido Legal has a unique ID number that can be used to identify the disbursement.

- Each disbursement must be tied to a client record. The disbursement may be optionally tied to a matter record as well.

- Clients have the option to accept payments for free. For any transactions where the client is charged for faster access to their funds, we charge a reasonable fee in line with other money transfer services.

Want more info? See our state-by-state guide on the ethics of online disbursements.

For more details on our security procedures, refer to this article.